by Jamie Redman

วันพุธที่ 11 ธันวาคม 2024

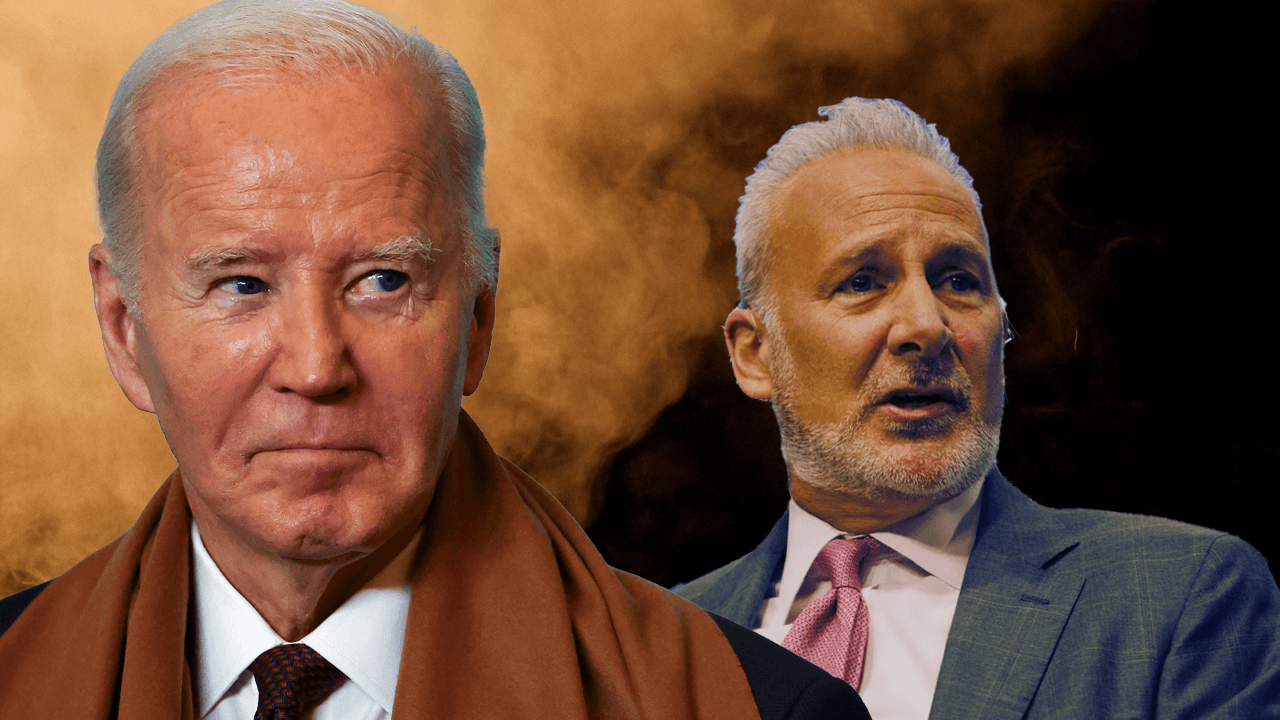

Gold advocate and economist Peter Schiff is not exactly cheering from the sidelines when it comes to a U.S. strategic bitcoin reserve. On Monday, he sparked conversation on social media, declaring that the smartest move President Joe Biden could make before leaving office is to offload all the U.S. government’s bitcoin holdings.

Schiff Wants Joe Biden to Put an End to All the Strategic Bitcoin Reserve Nonsense

The hype around a U.S. bitcoin reserve has been growing over the past few months, largely fueled by Senator Cynthia Lummis’s introduction of the “Bitcoin Act of 2024” and the return of Donald Trump, who has openly championed bitcoin (BTC). The legislation proposes creating a national bitcoin reserve to bolster the U.S. dollar and assert dominance in the crypto world.

Schiff, however, isn’t buying it. He’s called the plan a disaster waiting to happen, warning it would spell doom for the U.S. dollar. In November, he argued that aiming to become a bitcoin superpower would weaken America. Fast forward to Monday, and Schiff was back with more biting commentary, urging President Biden to make a decisive move with the government’s stash of seized bitcoin.

Schiff said:

The one good thing Biden can do before leaving office is sell all the bitcoin currently held by the U.S. Govt. Not only would the money raised reduce the 2024 budget deficit, but it would put an end to all the nonsense about creating a harmful ‘Strategic’ Bitcoin Reserve.

A bitcoin enthusiast shot back at Schiff with a cheeky remark, claiming the U.S. would simply end up buying bitcoin at a steeper price. “Trump already let the cat out of the bag,” the individual quipped, adding that rival nations are already crafting their own plans for strategic bitcoin reserves. “Game theory already won this, Peter,” the account declared confidently. The BTC advocate wrapped up their retort by taking a jab at gold, stating, “Gold’s market cap doesn’t stand a chance against bitcoin.”

Schiff wasn’t about to let that comment slide and quickly fired back at the bitcoin proponent. “No he won’t,” Schiff replied. ”He never promised to buy any bitcoin, just not to sell what the government already owns. Biden can do him a favor by selling it all before Trump takes office. That way Trump won’t have to break that campaign promise,” the gold advocate added.

Schiff’s commentary highlights the ideological divide between some gold proponents and crypto supporters. The clash reflects broader questions about national strategy in an era where digital currencies increasingly shape global financial influence. Whether a strategic bitcoin reserve would bolster or hinder U.S. dominance remains a contentious and unresolved issue among policymakers and financial pundits alike.

While Schiff’s staunch opposition highlights ongoing skepticism about bitcoin’s role in a national reserve or really in anything, the growing interest in the idea suggests a shifting narrative. As nations explore cryptocurrency strategies, the U.S. faces a pivotal choice: embrace bitcoin’s potential or reject it outright. The outcome of this debate could set a precedent for how major economies integrate digital assets into their fiscal and geopolitical frameworks.

At press time, the U.S. government’s stash of 198,109 BTC is worth $19.33 billion and if it sold it now to help with the 2024 budget it would barely scratch the surface.